The CBN has instructed banks to postpone charging for deposits until September. Accordingly, starting in September 2024, banks will charge 2% (N10k) for deposits over N500k for individuals and 2% (N60k) for deposits over N3 million for corporate account holders.

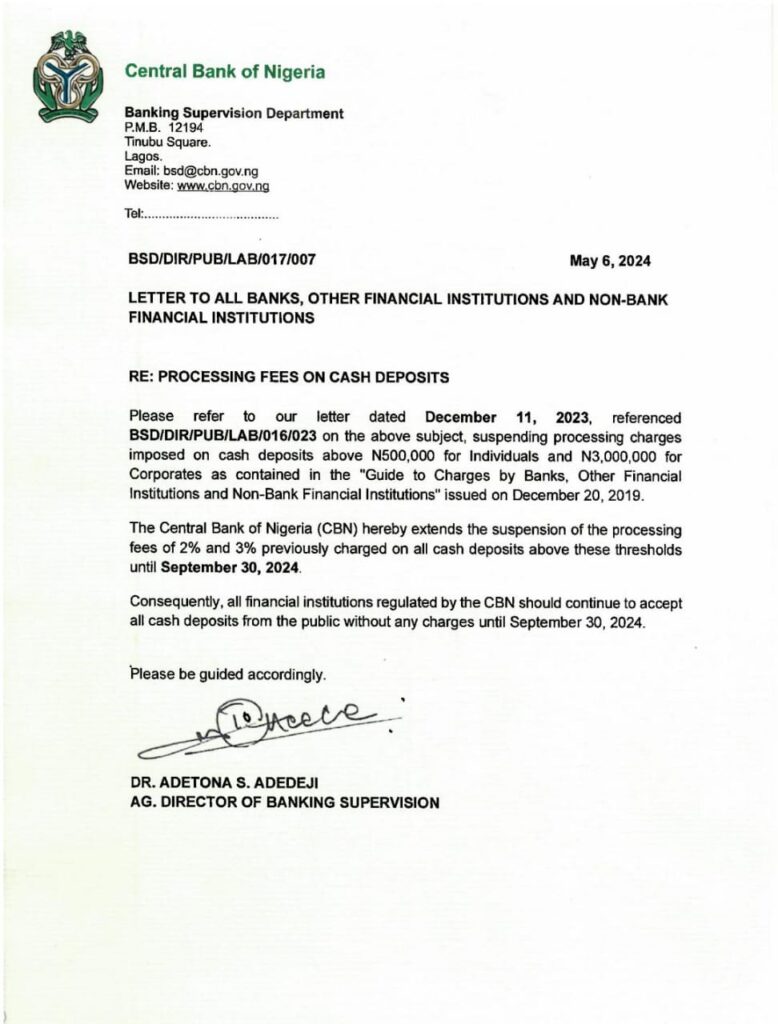

Until September 30, 2024, banks are unable to charge for cash deposits, according to a directive by the Central Bank of Nigeria. This was revealed by the highest-ranking bank in a May 6, 2024, circular that was signed by Adetona Adedeji, director of banking supervision.

A few Deposit Money Bank customers expressed worry over the fact that beginning of May 1, the banks started charging processing charges for cash deposits. According to the bank’s decision, deposits over N500,000 for individuals and N3 million for business account holders will incur fees of two percent each.

The above circular from CBN to financial and non-financial organizations states that the processing fees are not to be effected now. In details, the circular stated, “Please refer to our letter dated December 11, 2023, referenced BSD/DIR/PUB/LAB/ 016/023 on the above subject, suspending processing charges imposed on cash deposits above N500,000 for Individuals and N3,000,000 for Corporates as contained in the ‘Guide to Charges by Banks, Other Financial Institutions and Non-Bank Financial Institutions’ issued on December 20, 2019,” according to the CBN.

Therefore, The Central Bank of Nigeria has hereby directed all financial institutions to continue to accept all cash deposits from the public without any charges till the end of the third quarter.